Consolidating diverse data sources: Seamlessly integrating bank accounts, credit cards, and investment platforms with varying APIs and formats was akin to navigating a labyrinth. Each source required bespoke code and data normalisation techniques to ensure accuracy and consistency.

Real-time performance optimization: Delivering instant insights and automated actions demanded a robust data streaming architecture and low-latency processing capabilities. This ensured a smooth user experience even with substantial data volumes.

Personalised budgeting with machine learning: Building dynamic budgeting algorithms that adapt to individual income streams, spending patterns, and financial goals necessitated sophisticated machine learning models and real-time data analysis. This enabled Money4U to stay one step ahead of changing circumstances and provide tailored financial guidance.

Risk-adjusted investment strategies: Crafting AI-powered investment tools that balance risk tolerance with potential returns resembled walking a tightrope without a net. We employed advanced risk assessment techniques and market simulations to deliver secure and profitable investment strategies for each user.

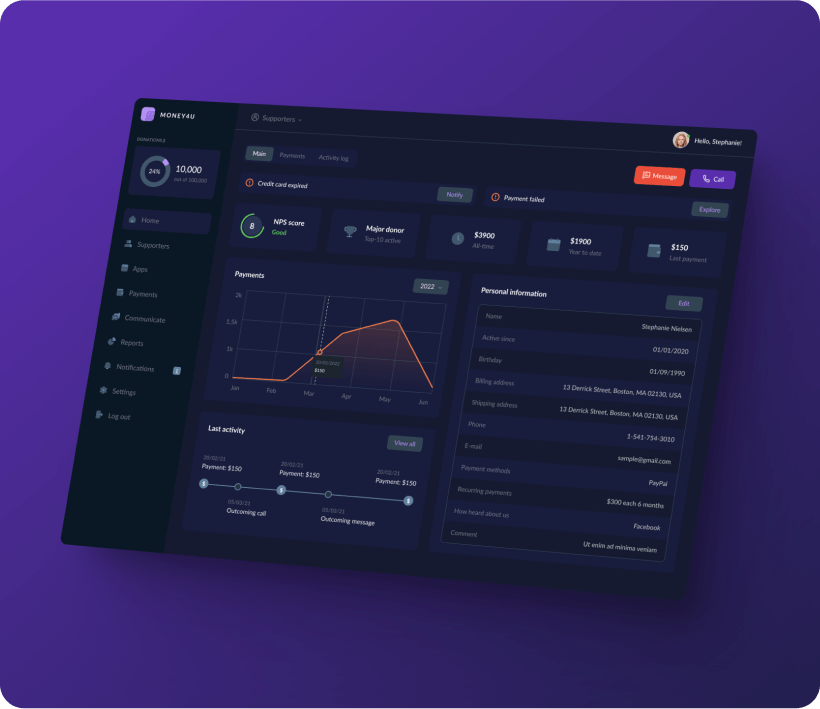

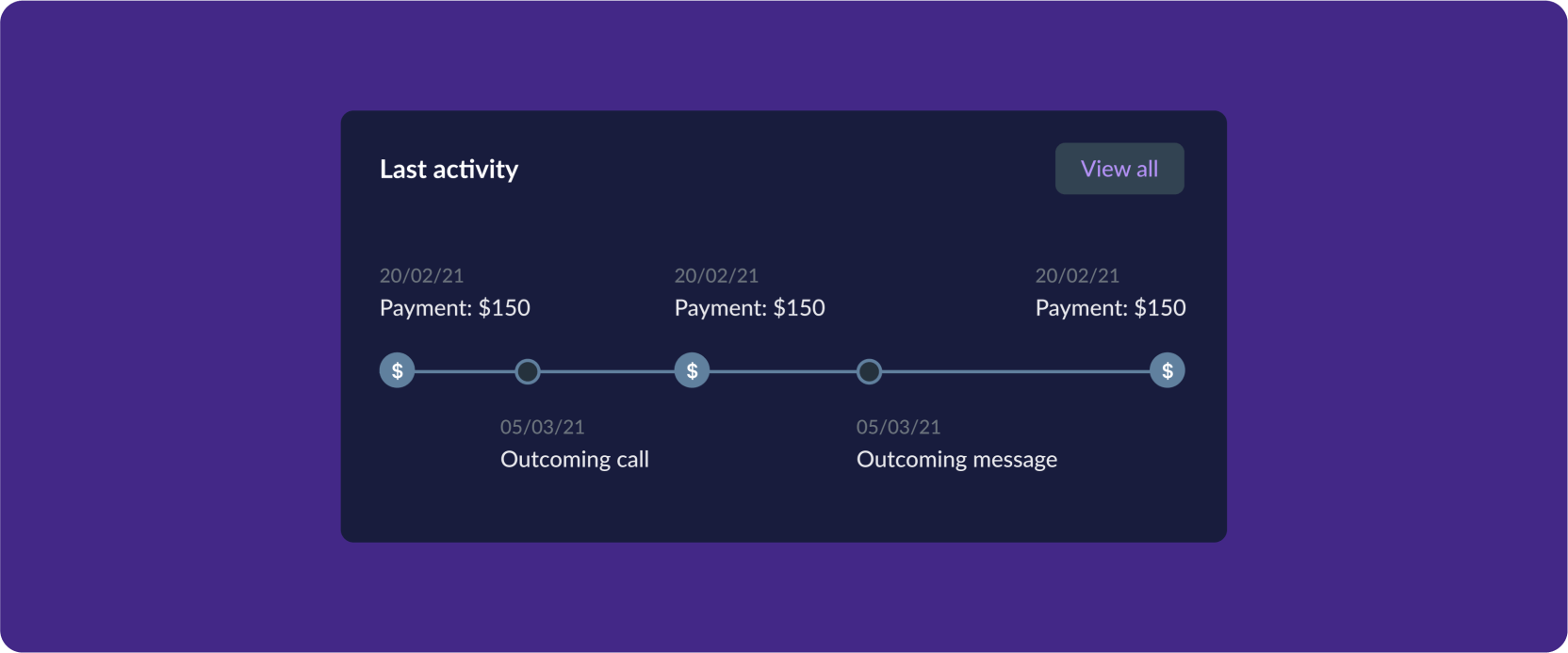

Financial Clarity at Your Fingertips: Automated Expense Tracking: We built Money4U to automatically track expenses, offering instant insights into spending patterns and habits, putting financial clarity in your hands.

Personalised Budgeting: Our team crafted algorithms to create adaptable, personalised budgets tailored to unique financial situations, revolutionising the traditional one-size-fits-all approach.

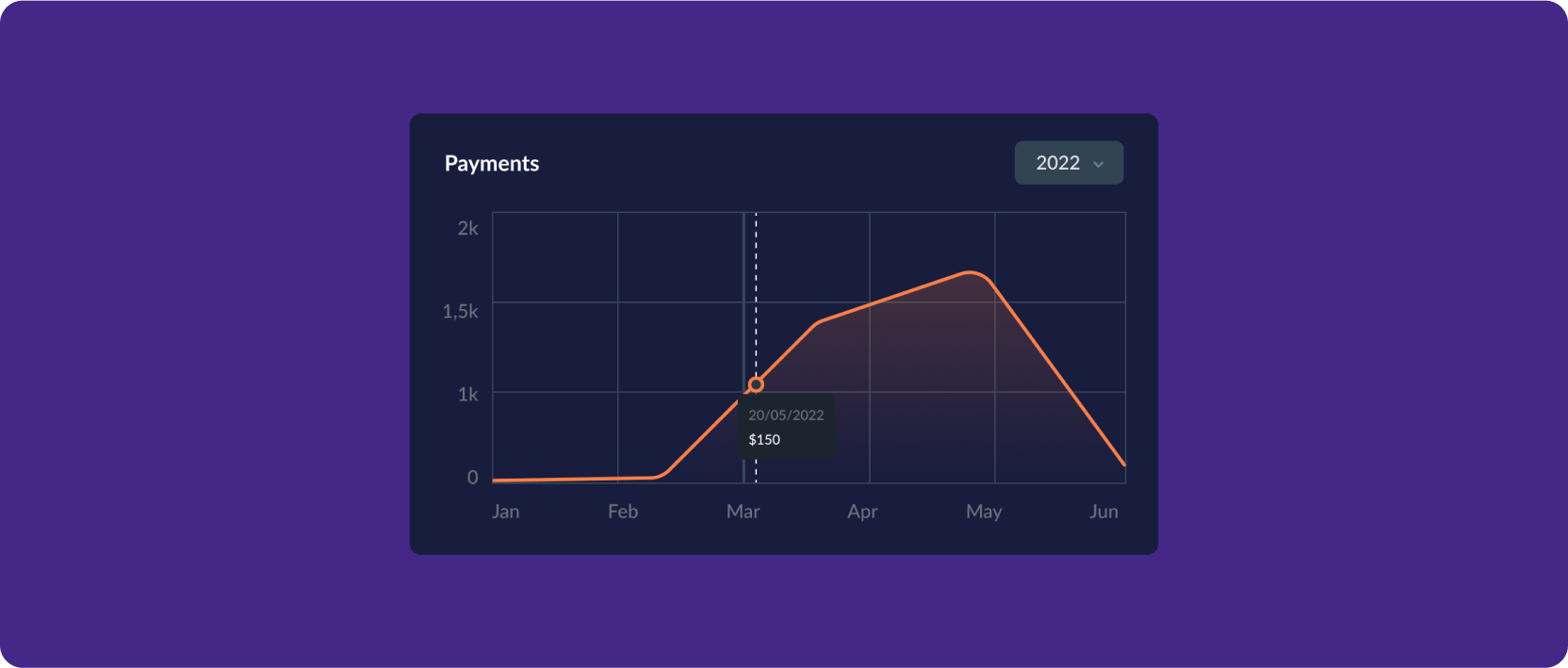

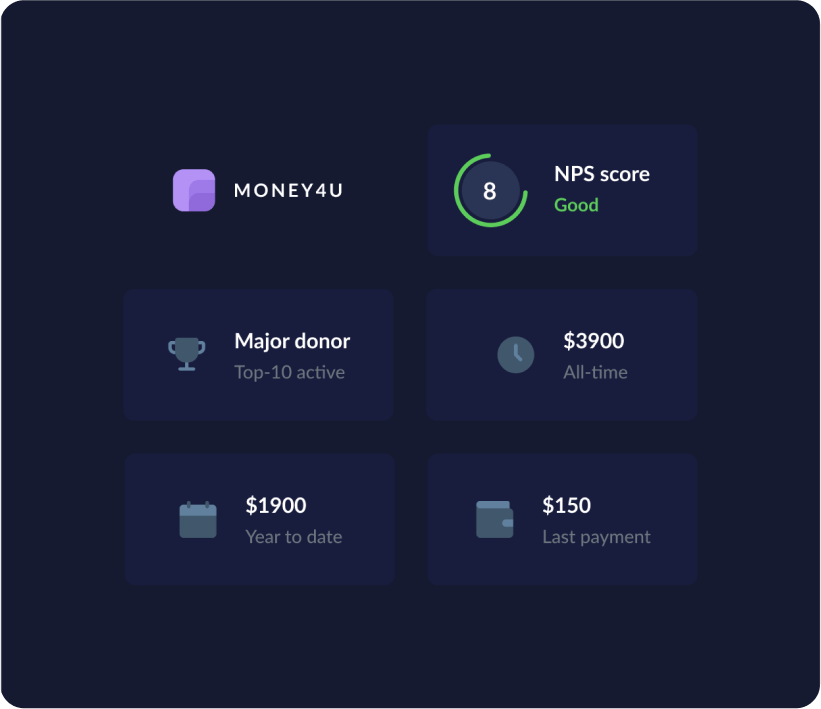

Visualised Progress Tracking: With interactive dashboards, users can monitor their progress towards financial goals, providing motivation and accountability.

Tailored Savings Strategies: Our AI-powered tools suggest customised savings strategies based on spending habits, accelerating progress towards financial goals.

Curated Investment Opportunities: Money4U offers tailored investment suggestions aligned with risk tolerance and financial objectives.

Financial Security at Your Fingertips: Robust Data Security- Our top priority was protecting user data. Money4U integrates industry-leading security measures to safeguard transactions and sensitive information.

Credit Health Tracking: Users can track credit scores in real-time and receive personalised advice to enhance creditworthiness, empowering better financial decisions.

ducational Resources: Money4U offers financial education articles, empowering users to make informed financial decisions for a secure financial future.

Improved Financial Understanding: We helped users gain deeper insights into their spending habits, fostering improved decision-making.

Improved Financial Understanding: We helped users gain deeper insights into their spending habits, fostering improved decision-making.

Empowering Goal Achievement: With personalised tools, 9Summits crafted Money4U to empower users to achieve financial aspirations efficiently.

We at 9Summits built Money4U to be more than an app; it's a personal finance coach empowering users to manage their finances with clarity, control, and confidence. Download Money4U today and unlock a smarter, simpler way to financial freedom.